SEC Form 4 2011-2025 free printable template

Show details

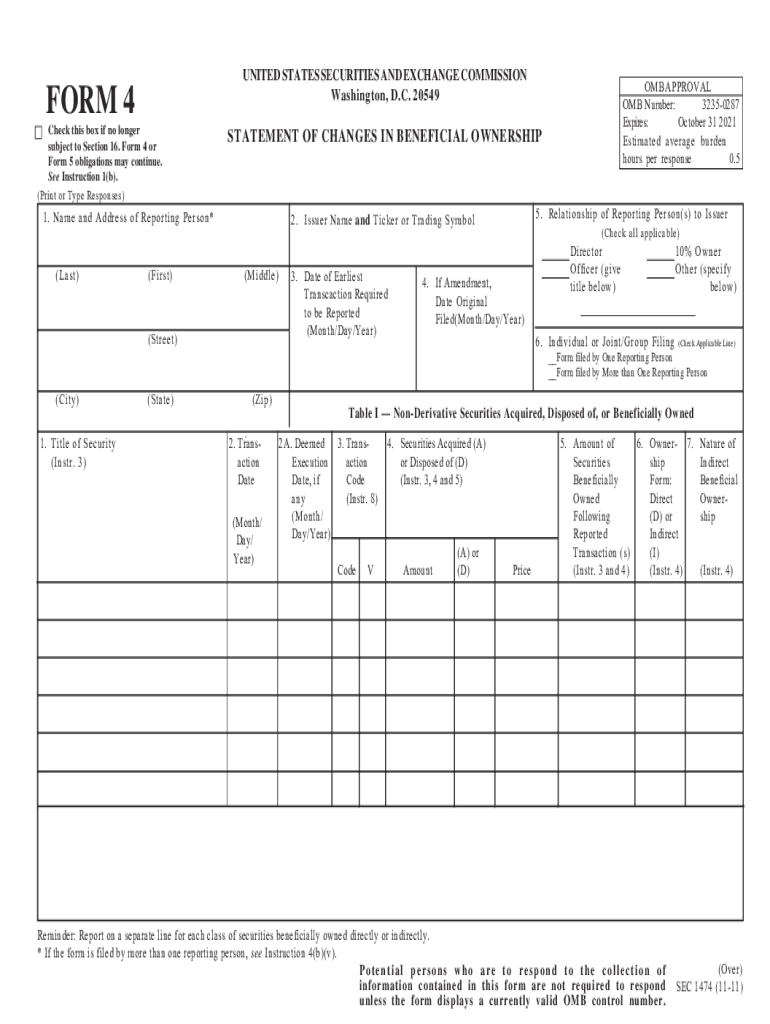

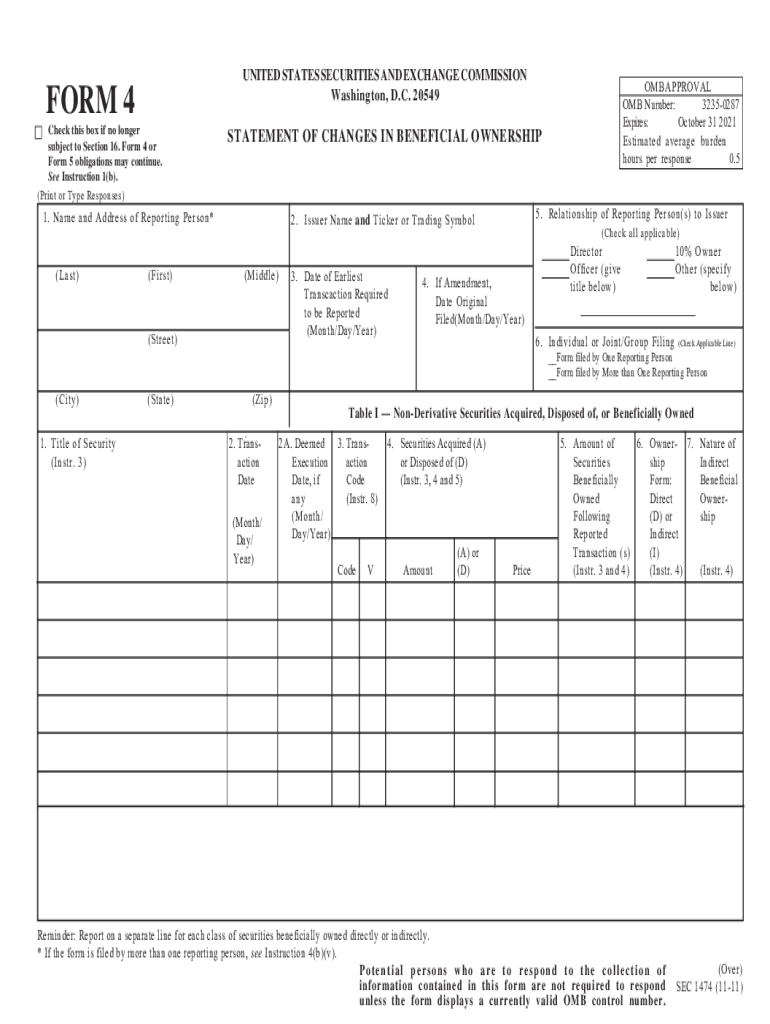

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington D.C. 20549 FORM 4 Check this box if no longer subject to Section 16. 2YHU FORM 4 continued Table II Derivative Securities Acquired Disposed of or Beneficially Owned e.g. puts calls warrants options convertible securities 7LWOH RI HULYDWLYH RQYHU 7UDQV HHPHG 7UDQV VLRQ RU DFWLRQ HFXWLRQ HUFLVH DWH DWH LI HUL 0RQWK 0RQWK YDWLYH D 6HFXULW HDU HU FLVDEOH 3ULFH 1XPEHU 2ZQHU 1DWXUH RI RI GHULY VKLS RUP RI 6HFXU HQHIL LWLHV FLDO HQH...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form4

Edit your sec form 4 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 4 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit where to mail form 4868 online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit how to form 4. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SEC Form 4 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out sec form 4 filing

How to fill out SEC Form 4

01

Begin by downloading SEC Form 4 from the SEC website or accessing it through the EDGAR system.

02

Enter the name of the reporting person in the appropriate field.

03

Provide the address of the reporting person.

04

Fill out the relationship of the reporting person to the issuer, such as officer, director, or affiliate.

05

Complete the table reflecting the transactions: indicate the date of the transaction, the amount of securities involved, and the nature of the transaction (e.g., purchase, sale, gift).

06

Include the ownership form of the securities (direct or indirect) in the table.

07

Sign the form, certifying that the information disclosed is accurate.

08

Submit the completed Form 4 electronically through the EDGAR system.

Who needs SEC Form 4?

01

Individuals who are corporate officers, directors, or beneficial owners of more than 10% of a registered class of equity securities need to file SEC Form 4 to disclose changes in their ownership of the company's securities.

Video instructions and help with filling out and completing how to form 4 fill in

Instructions and Help about 4 sec fill

Fill

sec form 4 filings

: Try Risk Free

People Also Ask about sec form4 search

What is ATF Form 4 for?

Form 4 - Application for Tax Paid Transfer and Registration of Firearm (ATF Form 5320.4) Application for tax paid transfer and registration of firearm used to request approval to transfer a National Firearms Act (NFA) firearm subject to transfer tax liability.

Who is required to file Form 4?

Every director, officer and owner of more than 10 percent of a class of a particular company's equity securities registered under Section 12 of the Securities Exchange Act of 1934 must file with the United States Securities and Exchange Commission a statement of ownership regarding such security.

What is Form 4 filing?

What's a Form 4? In most cases, when an insider executes a transaction, he or she must file a Form 4. With this form filing, the public is made aware of the insider's various transactions in company securities, including the amount purchased or sold and the price per share.

When must Form 4 be filed?

A Form 4 must be filed before the end of the second business day following a change in ownership of securities or derivative securities (including the exercise or grant of stock options) for individuals subject to Section 16 of the Securities Exchange Act of 1934.

What is the purpose of S-4 filing?

Form S-4 is the registration statement that the Securities and Exchange Commission (SEC) requires reporting companies to file in order to publicly offer new securities pursuant to a merger or acquisition.

What is the Form 4 amendment?

What is a Form 4 and When Does it Need to be Filed? Form 4 is a "Statement of Changes in Beneficial Ownership," required to be filed with the Securities and Exchange Commission by a company insider when they have a change in their beneficial ownership of the company's stock.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form 4 instructions without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including 4 sec, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I edit 4 sec sample online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your form 4 word version and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I fill out sec form 4 instructions on an Android device?

Use the pdfFiller mobile app and complete your how to sec form 4 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is SEC Form 4?

SEC Form 4 is a form used by the Securities and Exchange Commission (SEC) that must be filed by insiders of a company to report their transactions in the company's securities.

Who is required to file SEC Form 4?

Insiders of a company, including officers, directors, and shareholders owning more than 10% of the company's stock, are required to file SEC Form 4.

How to fill out SEC Form 4?

To fill out SEC Form 4, insiders must provide details about the transaction, including the date of the transaction, the nature of the transaction, the amount of securities involved, and the price at which the securities were bought or sold.

What is the purpose of SEC Form 4?

The purpose of SEC Form 4 is to provide transparency regarding the securities transactions of company insiders, allowing investors to see how insiders are trading in their own company's stock.

What information must be reported on SEC Form 4?

SEC Form 4 requires reporting of the insider's name, relationship to the issuer, transaction date, transaction type (buy, sell, etc.), amount of securities, price per security, and any other relevant details associated with the transaction.

Fill out your SEC Form 4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 4 Example is not the form you're looking for?Search for another form here.

Keywords relevant to 4 sec get

Related to 4 sec blank

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.